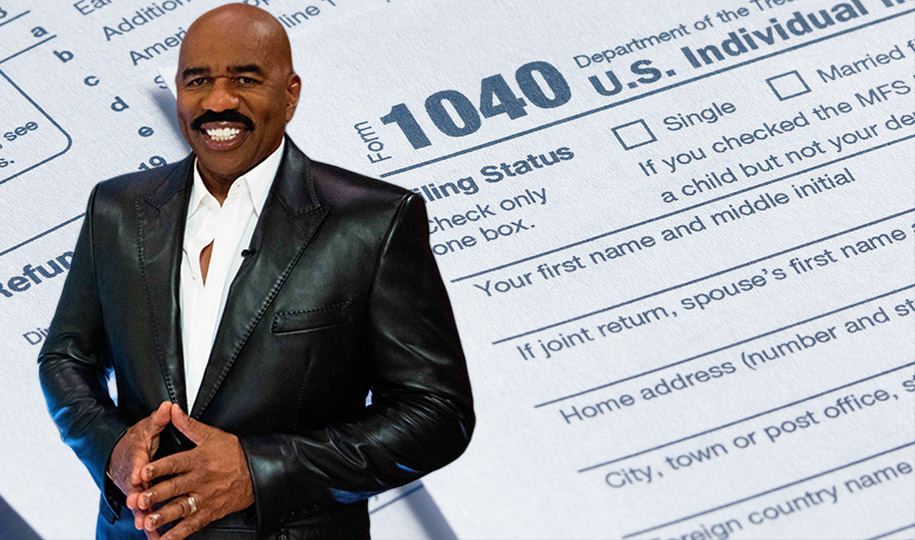

Steve Harvey IRS Debt refers to the $14,991,804 tax lien that the Internal Revenue Service (IRS) filed against Steve Harvey in 2008.

The IRS debt was a significant financial setback for Harvey, who is a popular comedian, actor, and television host. The debt was the result of unpaid taxes from 2007, and it led to the IRS seizing some of Harvey's assets, including his Chicago mansion.

Harvey has since paid off the debt, and he has spoken out about the importance of paying taxes.

Steve Harvey IRS Debt

Steve Harvey's IRS debt was a significant financial setback for the comedian, actor, and television host. The debt was the result of unpaid taxes from 2007, and it led to the IRS seizing some of Harvey's assets, including his Chicago mansion. Harvey has since paid off the debt, and he has spoken out about the importance of paying taxes.

- Amount: $14,991,804

- Year: 2008

- Reason: Unpaid taxes from 2007

- Assets seized: Chicago mansion

- Repayment status: Paid off

- Public response: Harvey has spoken out about the importance of paying taxes.

- Financial impact: Harvey's net worth is estimated to be $200 million, so the debt represented a significant financial setback.

- Legal implications: The IRS can seize assets and impose penalties on individuals who fail to pay their taxes.

Harvey's IRS debt is a reminder that even celebrities are not immune to financial problems. It is also a reminder of the importance of paying taxes. The IRS has the authority to seize assets and impose penalties on individuals who fail to pay their taxes. If you are having trouble paying your taxes, you should contact the IRS to discuss your options.

Amount

The amount of Steve Harvey's IRS debt, $14,991,804, is a significant figure that highlights the seriousness of his tax problems. The debt was the result of unpaid taxes from 2007, and it led to the IRS seizing some of Harvey's assets, including his Chicago mansion. Harvey has since paid off the debt, but the amount serves as a reminder of the financial consequences of failing to pay taxes.

The amount of Harvey's debt is also significant because it shows that even celebrities are not immune to financial problems. Harvey is a successful comedian, actor, and television host, but he still had to deal with a large tax debt. This shows that everyone, regardless of their income or wealth, needs to be aware of their tax obligations.

The amount of Harvey's debt is also a reminder of the importance of paying taxes. The IRS has the authority to seize assets and impose penalties on individuals who fail to pay their taxes. If you are having trouble paying your taxes, you should contact the IRS to discuss your options.

Year

The year 2008 was a significant one in the context of "steve harvey irs debt" for several reasons:

- The debt was incurred in 2008. Harvey failed to pay his taxes for the year 2007, which led to the IRS filing a tax lien against him in 2008.

- The debt became public in 2008. The IRS tax lien was filed in Cook County, Illinois, and became a matter of public record. This brought Harvey's tax problems to the attention of the media and the public.

- The debt led to the seizure of Harvey's assets in 2008. The IRS seized Harvey's Chicago mansion in an effort to collect the debt.

- Harvey began to repay the debt in 2008. Harvey made a significant payment on the debt in 2008, and he continued to make payments until the debt was fully paid off.

The year 2008 was a difficult one for Harvey financially, but he was able to overcome his tax problems and repay his debt. His story is a reminder that even celebrities are not immune to financial problems, and that it is important to pay your taxes.

Reason

The unpaid taxes from 2007 were the primary reason behind Steve Harvey's IRS debt. When individuals fail to pay their taxes by the April 15th deadline, they may incur penalties and interest charges. If the debt remains unpaid, the IRS may take further action, including filing a tax lien or seizing assets.

In Harvey's case, the IRS filed a tax lien against him in 2008 for the unpaid taxes from 2007. The IRS also seized his Chicago mansion in an effort to collect the debt.

- Failure to file a tax return: Individuals who fail to file a tax return may incur penalties and interest charges. The IRS may also estimate the taxpayer's liability based on available information, which may result in a higher tax bill.

- Failure to pay taxes by the deadline: Individuals who fail to pay their taxes by the April 15th deadline may incur penalties and interest charges. The IRS may also take further action, such as filing a tax lien or seizing assets.

- Underreporting income: Individuals who underreport their income may incur penalties and interest charges. The IRS may also assess additional taxes based on the unreported income.

- Claiming excessive deductions or credits: Individuals who claim excessive deductions or credits may incur penalties and interest charges. The IRS may also disallow the deductions or credits, resulting in a higher tax bill.

The consequences of unpaid taxes can be significant, including penalties, interest charges, tax liens, and asset seizures. It is important to file your taxes on time and pay your taxes in full to avoid these consequences.

Assets seized

In 2008, the IRS seized Steve Harvey's Chicago mansion to collect on his unpaid taxes. This action highlights the serious consequences of failing to pay your taxes, even for celebrities with substantial assets.

- The IRS has the authority to seize assets to collect unpaid taxes. This includes real estate, vehicles, and other valuable property. The IRS may also seize assets if it believes that the taxpayer is attempting to hide or sell assets to avoid paying taxes.

- The IRS typically seizes assets after other collection methods have failed. For example, the IRS may first try to collect the debt by sending a bill or garnishing wages. If these methods are unsuccessful, the IRS may resort to seizing assets.

- The IRS may sell seized assets to satisfy the tax debt. The IRS will typically sell the assets at a public auction. The proceeds from the sale will be applied to the taxpayer's debt.

- The taxpayer may be able to redeem seized assets. To do this, the taxpayer must pay the full amount of the tax debt, plus interest and penalties.

The seizure of Steve Harvey's Chicago mansion is a reminder that the IRS has the authority to take aggressive action to collect unpaid taxes. It is important to file your taxes on time and pay your taxes in full to avoid the risk of having your assets seized.

Repayment status

The fact that Steve Harvey's IRS debt is "Paid off" is a significant development that highlights his commitment to fulfilling his financial obligations and resolving his tax issues.

The repayment of his debt is a positive step for Harvey, as it allows him to move forward from this chapter in his life. It also serves as a reminder of the importance of paying taxes and addressing financial responsibilities in a timely manner.

The practical significance of understanding the connection between "Repayment status: Paid off" and "steve harvey irs debt" is that it provides a valuable lesson in financial responsibility and the consequences of failing to pay taxes. Harvey's experience demonstrates that even individuals with substantial wealth can face serious financial consequences for unpaid taxes.

However, Harvey's ability to repay his debt also shows that it is possible to overcome financial setbacks and resolve tax issues. By addressing his debt head-on and making a commitment to repay it, Harvey has demonstrated a sense of accountability and a willingness to take responsibility for his actions.

In conclusion, the "Repayment status: Paid off" is a crucial component of "steve harvey irs debt" as it signifies Harvey's commitment to fulfilling his financial obligations and resolving his tax issues. His experience serves as a reminder of the importance of paying taxes and addressing financial responsibilities in a timely manner, as well as the potential consequences of failing to do so.

Public response

Following the revelation of his IRS debt, Steve Harvey has publicly emphasized the significance of tax compliance. This response holds relevance in the context of "steve harvey irs debt" as it:

- Promotes Tax Awareness: Harvey's platform has enabled him to raise awareness about tax obligations and their consequences. By sharing his personal experience, he highlights the importance of understanding tax laws and the potential repercussions of non-compliance.

- Encourages Responsible Citizenship: Harvey's message underscores the civic duty of paying taxes. Taxes contribute to the funding of essential public services and infrastructure, and Harvey's advocacy encourages individuals to fulfill their responsibilities as citizens.

- Provides a Cautionary Tale: Harvey's experience serves as a cautionary tale, demonstrating the financial and reputational risks associated with unpaid taxes. His public statements may deter others from making similar mistakes and encourage timely tax payments.

- Fosters Trust in the Tax System: Harvey's willingness to address his tax issues publicly demonstrates his commitment to transparency and accountability. This can contribute to building trust in the tax system and encourage voluntary compliance.

In conclusion, the public response from Steve Harvey regarding the importance of paying taxes is a crucial aspect of "steve harvey irs debt" as it raises awareness, promotes responsible citizenship, provides a cautionary tale, and fosters trust in the tax system.

Financial impact

The connection between "Financial impact: Harvey's net worth is estimated to be $200 million, so the debt represented a significant financial setback" and "steve harvey irs debt" highlights the substantial impact that unpaid taxes can have on an individual's financial well-being, regardless of their wealth.

- Reduced Net Worth: The $14.9 million IRS debt represented a significant reduction in Harvey's overall net worth. Despite his substantial wealth, the debt eroded a significant portion of his assets.

- Potential Loss of Assets: Unpaid tax debts can lead to the seizure of assets, including real estate, vehicles, and other valuable property. In Harvey's case, the IRS seized his Chicago mansion, demonstrating the potential consequences of failing to pay taxes.

- Damaged Reputation: Public figures like Harvey often face intense scrutiny regarding their financial dealings. The revelation of his IRS debt damaged his reputation and could have negative implications for his career.

- Limited Investment Opportunities: A significant tax debt can limit an individual's ability to invest and grow their wealth. The money used to repay the debt could have otherwise been invested in income-generating assets.

In conclusion, the financial impact of Steve Harvey's IRS debt serves as a cautionary tale about the severe consequences of unpaid taxes. Even individuals with substantial wealth are not immune to the financial and reputational risks associated with tax non-compliance.

Legal implications

The legal implications of failing to pay taxes are significant and can have serious consequences, as exemplified by the case of "steve harvey irs debt." The Internal Revenue Service (IRS) has the authority to seize assets and impose penalties on individuals who fail to meet their tax obligations.

- Asset Seizure: The IRS has the legal authority to seize assets, including real estate, vehicles, and other valuable property, to satisfy unpaid tax debts. In Steve Harvey's case, the IRS seized his Chicago mansion as part of their efforts to collect the $14.9 million debt.

- Penalties and Interest: In addition to asset seizure, the IRS can impose significant penalties and interest charges on unpaid taxes. These penalties can accumulate rapidly, further increasing the amount owed.

- Criminal Charges: In severe cases, the IRS may pursue criminal charges against individuals who willfully fail to pay their taxes. These charges can result in imprisonment and substantial fines.

- Revocation of Licenses: The IRS has the authority to revoke professional licenses, such as medical or law licenses, for individuals who have outstanding tax debts. This can have a devastating impact on one's ability to earn a living.

The legal implications of failing to pay taxes are a reminder of the importance of fulfilling one's tax obligations. The IRS has a wide range of enforcement tools at its disposal, and individuals who fail to pay their taxes may face severe consequences.

FAQs on "steve harvey irs debt"

This section addresses frequently asked questions surrounding Steve Harvey's IRS debt, providing clear and informative answers to common concerns and misconceptions.

Question 1: What was the amount of Steve Harvey's IRS debt?

Steve Harvey's IRS debt amounted to $14,991,804, a substantial sum that highlights the severe consequences of unpaid taxes.

Question 2: Why did Steve Harvey incur such a large tax debt?

Harvey's significant tax debt stemmed from unpaid taxes for the year 2007. Failing to fulfill tax obligations within the stipulated deadlines can lead to substantial penalties and interest charges.

Question 3: What actions did the IRS take to collect the debt?

The IRS seized Harvey's Chicago mansion in an attempt to collect the unpaid taxes. Asset seizure is a common measure employed by the IRS to recover outstanding tax debts.

Question 4: Has Steve Harvey repaid his IRS debt?

Yes, Steve Harvey has since paid off his IRS debt in full. Repaying the debt demonstrates his commitment to fulfilling financial obligations and resolving tax issues.

Question 5: What are the potential consequences of failing to pay taxes?

Unpaid taxes can result in severe consequences, including asset seizure, penalties, interest charges, and even criminal charges in severe cases. It is crucial to fulfill tax obligations to avoid such repercussions.

Question 6: What lessons can be learned from Steve Harvey's experience with IRS debt?

Harvey's case serves as a cautionary tale about the importance of paying taxes on time and in full. It highlights the financial and legal consequences of tax non-compliance and emphasizes the need for responsible financial management.

In summary, Steve Harvey's IRS debt underscores the significance of fulfilling tax obligations and the potential repercussions of failing to do so. Understanding the details and implications of this case can help individuals make informed decisions regarding their tax responsibilities.

Transition to the next article section...

Tips Regarding "steve harvey irs debt"

Understanding the complexities surrounding "steve harvey irs debt" can empower individuals to make informed decisions and avoid potential pitfalls. Here are some essential tips to consider:

Tip 1: File Taxes on Time

Punctuality in filing tax returns is paramount. Missing tax deadlines can result in penalties and interest charges, leading to an increased tax burden.

Tip 2: Pay Taxes in Full

To avoid debt accumulation and potential legal consequences, it is crucial to settle tax liabilities in their entirety. Explore payment options if immediate full payment is not feasible.

Tip 3: Seek Professional Advice

Navigating tax matters can be complex. Consulting with a tax professional, such as a certified public accountant (CPA), can provide expert guidance and ensure proper tax compliance.

Tip 4: Understand Tax Implications

Educate yourself about tax laws and regulations to make informed financial decisions. Knowledge of tax deductions, credits, and exemptions can help minimize tax liability.

Tip 5: Keep Accurate Records

Maintain organized and detailed financial records to support tax filings. This will facilitate efficient tax preparation and minimize the risk of errors.

Tip 6: Avoid Tax Evasion

Intentionally failing to pay taxes is a serious offense with severe legal consequences. Seek professional assistance if you encounter difficulties in meeting tax obligations.

Tip 7: Utilize Payment Plans

The IRS offers payment plans for taxpayers facing financial challenges. These plans allow for gradual debt repayment, avoiding the burden of a lump sum payment.

Tip 8: Be Aware of Tax Scams

Remain vigilant against fraudulent schemes that impersonate the IRS. The IRS will never demand immediate payment or request personal information via phone or email.

By adhering to these tips, individuals can navigate tax obligations effectively, minimize financial risks, and maintain compliance with tax regulations.

Proceed to the conclusion of the article...

Conclusion

The examination of "steve harvey irs debt" underscores the paramount importance of responsible tax management and compliance. Failure to fulfill tax obligations can lead to severe financial and legal consequences, as exemplified by Steve Harvey's experience.

This article has highlighted key aspects of tax compliance, including the significance of timely tax filing, complete tax payment, and the potential implications of non-compliance. Understanding these aspects empowers individuals to make informed financial decisions and avoid the pitfalls associated with unpaid taxes.

The tips provided within this article offer practical guidance for navigating tax responsibilities effectively. By implementing these tips, individuals can minimize financial risks, maintain compliance, and build a solid foundation for their financial well-being.

In conclusion, responsible tax management is a cornerstone of financial stability and legal compliance. By adhering to tax laws and regulations, individuals can safeguard their financial interests and contribute to the effective functioning of society.

Discover The Culinary Empire And Salary Secrets Of Hunter Fieri

Unveiling The Truth: Status And Secrets Of Tyson Beckford's Marital Life

Unveiling The Untold Story Of Kara Swisher's Marriage: Discoveries And Insights

Steve Harvey Got Out Of 25M IRS Debt 3 Things To Know About How He

86 Steve Harvey What Makes a Man in Today's World

ncG1vNJzZmionKS7tbvSa2WapaNoe6W1xqKrmqSfmLKiutKpmJydo2OwsLmOrKuerpVitaK%2B1Z6wZqGiqHqlscGtZaGsnaE%3D