Todd Helton's net worth is the total value of his assets minus the total value of his liabilities. Assets include cash, stocks, bonds, real estate, and other valuable items. Liabilities include debts such as mortgages, car loans, and credit card balances. Net worth is an important financial metric that provides a snapshot of an individual's financial health.

A person with a high net worth is typically considered to be wealthy, while someone with a low net worth may be considered to be poor. Net worth can be used to track an individual's financial progress over time, and compare to financial health of others. The concept of tracking net worth is rooted in double-entry bookkeeping and has been a standard practice in the financial sector for nearly 600 years.

In this article, we will explore Todd Helton's net worth, including his income and spending habits. We will also discuss the factors that have contributed to his financial success.

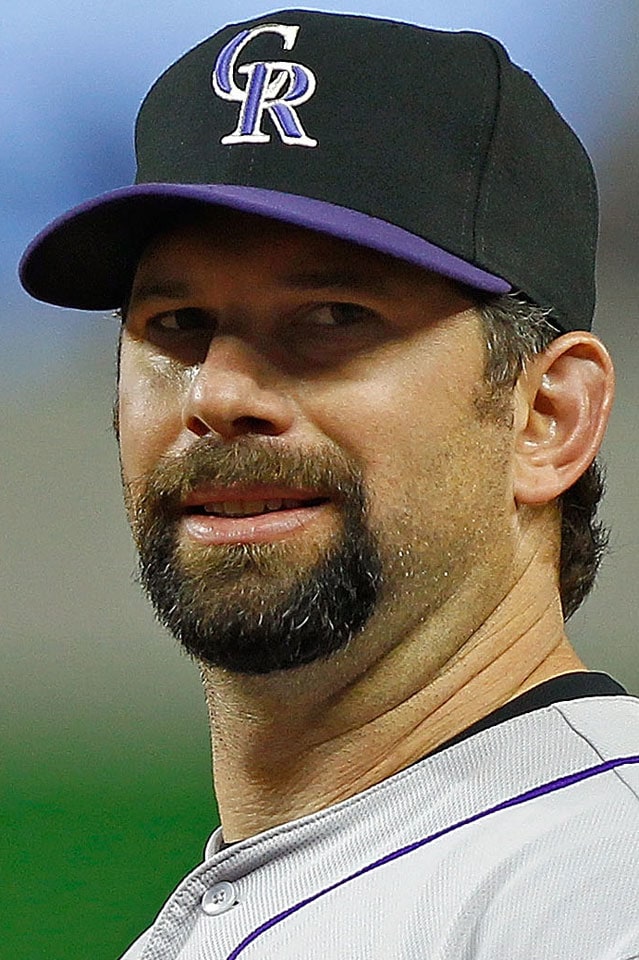

Todd Helton Net Worth

Todd Helton's net worth is a measure of his financial health. It is calculated by subtracting his liabilities from his assets. There are many different factors that can affect a person's net worth, including their income, spending habits, and investments. In this article, we will explore some of the key aspects of Todd Helton's net worth.

- Income

- Spending

- Investments

- Assets

- Liabilities

- Net worth

- Financial planning

- Estate planning

- Philanthropy

These are just some of the key aspects of Todd Helton's net worth. By understanding these aspects, we can gain a better understanding of his financial situation and how he has achieved success.

Income

Income is an important component of Todd Helton's net worth. It is the primary way that he generates wealth and increases his net worth. Helton's income comes from a variety of sources, including his salary as a professional baseball player, his endorsements, and his investments.

Helton's salary as a professional baseball player is his primary source of income. He has played in the Major Leagues for over 20 years and has earned over $150 million in salary alone. Helton's endorsements are another significant source of income. He has endorsement deals with a number of companies, including Nike, Pepsi, and State Farm. Helton's investments are a third source of income. He has invested in a variety of assets, including stocks, bonds, and real estate.

The relationship between income and net worth is a direct one. The more income that Helton generates, the higher his net worth will be. This is because income is added to net worth, while expenses are subtracted from net worth. Therefore, it is important for Helton to continue to generate income in order to maintain and grow his net worth.

The practical applications of understanding the relationship between income and net worth are numerous. For example, this understanding can be used to make informed financial decisions, such as how much to save and invest. Additionally, this understanding can be used to track financial progress and to set financial goals.

Spending

Spending is a critical component of Todd Helton's net worth. It is the primary way that he reduces his net worth. Helton's spending can be divided into two categories: essential spending and discretionary spending. Essential spending is spending that is necessary for Helton to maintain his lifestyle, such as food, housing, and transportation. Discretionary spending is spending that is not necessary, such as entertainment, travel, and luxury goods.

The relationship between spending and net worth is an inverse one. The more that Helton spends, the lower his net worth will be. This is because spending reduces the amount of money that Helton has available to invest and grow his net worth. Therefore, it is important for Helton to be mindful of his spending habits and to ensure that he is not spending more than he can afford.

There are a number of practical applications of understanding the relationship between spending and net worth. For example, this understanding can be used to make informed financial decisions, such as how much to save and invest. Additionally, this understanding can be used to track financial progress and to set financial goals.

In conclusion, spending is a critical component of Todd Helton's net worth. It is important for Helton to be mindful of his spending habits and to ensure that he is not spending more than he can afford. By understanding the relationship between spending and net worth, Helton can make informed financial decisions and achieve his financial goals.

Investments

Investments are a critical component of Todd Helton's net worth. They are a way for him to grow his wealth and increase his net worth over time. Helton has invested in a variety of assets, including stocks, bonds, and real estate. These investments have helped him to grow his net worth significantly over the years.

The relationship between investments and net worth is a direct one. The more that Helton invests, the higher his net worth will be. This is because investments earn returns over time, which are added to Helton's net worth. Therefore, it is important for Helton to continue to invest in order to maintain and grow his net worth.

There are a number of practical applications of understanding the relationship between investments and net worth. For example, this understanding can be used to make informed financial decisions, such as how much to save and invest. Additionally, this understanding can be used to track financial progress and to set financial goals.

In conclusion, investments are a critical component of Todd Helton's net worth. They are a way for him to grow his wealth and increase his net worth over time. By understanding the relationship between investments and net worth, Helton can make informed financial decisions and achieve his financial goals.

Assets

Assets are a crucial component of Todd Helton's net worth, representing the resources and valuables he owns. They contribute significantly to his overall financial well-being and provide a foundation for his future financial security.

- Cash and Cash Equivalents: This category includes cash on hand, checking and savings accounts, and money market accounts. These assets are highly liquid, allowing Helton to access funds quickly for various expenses or investments.

- Investments: Helton's investment portfolio likely consists of a diversified mix of stocks, bonds, and mutual funds. These investments have the potential to generate returns over time, contributing to the growth of his net worth.

- Real Estate: Helton may own residential or commercial properties, which can provide both rental income and potential appreciation in value. Real estate can be a significant asset class in his portfolio.

- Personal Property: This includes items such as vehicles, jewelry, artwork, and collectibles. While these assets may have sentimental value, they can also contribute to Helton's net worth.

The value of Helton's assets fluctuates over time based on market conditions and other factors. However, by managing his assets effectively and making strategic investments, he can enhance their value and positively impact his overall net worth.

Liabilities

Liabilities are an essential aspect of Todd Helton's net worth, representing the financial obligations and debts he owes. Understanding them is crucial for assessing his overall financial health and stability. Here are some key facets of Helton's liabilities:

- Mortgages: Helton may have mortgages on his primary residence and any additional properties he owns. These long-term loans represent a significant liability, impacting his cash flow and net worth.

- Loans: Helton may have outstanding loans, such as personal loans, car loans, or business loans. These obligations create a repayment schedule that affects his financial resources and overall net worth.

- Taxes: Helton is liable for various taxes, including income tax, property tax, and sales tax. These obligations reduce his disposable income and impact his net worth.

- Other Liabilities: Helton may have additional liabilities, such as credit card debt, legal judgments, or contractual obligations. These debts and commitments can accumulate over time, potentially straining his financial situation.

Overall, liabilities play a crucial role in determining Todd Helton's net worth. By managing his liabilities effectively, such as paying down debt and minimizing interest payments, he can improve his financial stability and increase his overall net worth.

Net worth

Net worth is a crucial indicator of an individual's financial health, representing the total value of their assets minus their liabilities. In the context of Todd Helton Net Worth, net worth plays a central role in assessing his overall financial standing and economic well-being. The connection between "net worth" and "Todd Helton Net Worth" is multifaceted and interdependent.

Firstly, net worth is a direct reflection of Todd Helton's financial decisions and their impact on his assets and liabilities. Strategic investment choices, wise spending habits, and effective debt management contribute to a higher net worth. Conversely, impulsive spending, poor investment decisions, and excessive debt can erode net worth over time.

Real-life examples from Todd Helton's financial history can illustrate this connection. His prudent investment in real estate, for instance, has reportedly generated substantial returns, positively impacting his net worth. On the other hand, high-interest loans or excessive spending on luxury items could potentially reduce his net worth if not managed responsibly.

Understanding the relationship between net worth and Todd Helton Net Worth has practical applications in financial planning and decision-making. By monitoring his net worth over time, Helton can identify trends, evaluate the effectiveness of his financial strategies, and make informed adjustments to enhance his financial well-being. This understanding empowers him to set realistic financial goals, plan for retirement, and navigate financial challenges effectively.

Financial planning

Financial planning is a critical component of Todd Helton Net Worth. It involves setting financial goals, creating a budget, and developing a strategy to achieve those goals. By planning for their financial future, individuals can make informed decisions about how to allocate their resources and maximize their wealth.

For Todd Helton, financial planning has played a significant role in his ability to accumulate wealth and maintain a high net worth. Throughout his career, he has consistently invested his earnings wisely, focusing on long-term growth rather than short-term gains. Additionally, he has been disciplined in his spending habits, avoiding excessive debt and unnecessary expenses.

One of the key benefits of financial planning is that it can help individuals avoid financial pitfalls and make sound decisions that contribute to their overall wealth. For example, by creating a budget, Todd Helton can track his income and expenses, ensuring that he is living within his means and not overspending. This helps him maintain a positive cash flow and avoid the accumulation of debt, which can negatively impact his net worth. Furthermore, by setting long-term financial goals and developing a strategy to achieve them, Todd Helton can make informed investment decisions that align with his risk tolerance and time horizon.

In summary, financial planning is a vital aspect of Todd Helton Net Worth. By engaging in sound financial planning practices, he has been able to grow his wealth, achieve his financial goals, and secure his financial future.

Estate planning

Estate planning is a critical component of Todd Helton Net Worth. It involves creating a plan to manage the distribution of an individual's assets after their death. Estate planning can help to ensure that Helton's assets are distributed according to his wishes and that his family is provided for after he is gone. There are a number of different estate planning tools that can be used to achieve these goals, including wills, trusts, and powers of attorney.

One of the most important reasons to create an estate plan is to avoid probate. Probate is the legal process of administering a deceased person's estate. It can be a lengthy and expensive process, and it can result in the distribution of assets in a way that is not consistent with the deceased person's wishes. By creating an estate plan, Helton can avoid probate and ensure that his assets are distributed according to his wishes.

In addition to avoiding probate, estate planning can also help to reduce taxes. There are a number of different tax-saving strategies that can be used in estate planning, such as using trusts and gifting assets to family members. By using these strategies, Helton can reduce the amount of taxes that his estate will owe, which can save his family money in the long run.

Overall, estate planning is a critical component of Todd Helton Net Worth. By creating an estate plan, Helton can ensure that his assets are distributed according to his wishes, that his family is provided for after he is gone, and that his estate is as tax-efficient as possible.

Philanthropy

Philanthropy plays a significant role in Todd Helton's financial legacy. By generously donating a portion of his wealth to charitable causes, Helton demonstrates his commitment to giving back to the community and making a positive impact on the world.

- Community Involvement

Helton is deeply involved in his local community, supporting organizations that focus on youth development, education, and healthcare. His contributions have helped fund scholarships, after-school programs, and medical research.

- National Impact

Helton's philanthropic efforts extend beyond his hometown. He has donated to national organizations dedicated to causes such as cancer research, disaster relief, and environmental protection.

- International Outreach

Helton's charitable reach extends globally. He has supported organizations that provide humanitarian aid, promote education, and empower communities in developing countries.

- Legacy Building

Helton's philanthropy is not just about making one-time donations. He has established a foundation that will continue to support charitable causes long after his playing days are over.

Helton's philanthropic endeavors have not only benefited the lives of others but have also enhanced his own financial legacy. By giving back to the community, he has demonstrated his values and created a lasting impact that will continue to inspire others.

Frequently Asked Questions About Todd Helton Net Worth

The following frequently asked questions (FAQs) provide insights into key aspects of Todd Helton's net worth, addressing common queries and clarifying misconceptions.

Question 1: What is Todd Helton's net worth?As of 2023, Todd Helton's net worth is estimated to be around $70 million.

Question 2: How did Todd Helton accumulate his wealth?

Helton's wealth primarily stems from his successful baseball career, including his salary, endorsements, and investments.

Question 3: What are Todd Helton's major assets?

Helton's assets include his primary residence, investment properties, and a diversified portfolio of stocks and bonds.

Question 4: Does Todd Helton have any significant liabilities?

Helton's liabilities primarily consist of mortgages on his properties and potential tax obligations.

Question 5: How does Todd Helton manage his finances?

Helton is known for his prudent financial management, including strategic investments and responsible spending habits.

Question 6: What is Todd Helton's financial legacy?

Helton's financial success extends beyond his personal wealth, as he has made significant contributions to charitable causes through his philanthropy.

These FAQs provide a comprehensive overview of Todd Helton's net worth and key financial aspects. For further insights into his financial journey and strategies, explore the following sections of the article.

Tips for Building Wealth

The following tips can help you build wealth and achieve financial success:

Tip 1: Create a budget and stick to it.

A budget will help you track your income and expenses, ensuring that you are living within your means and not overspending.

Tip 2: Save early and often.

The sooner you start saving, the more time your money has to grow. Even small savings can add up over time.

Tip 3: Invest your money wisely.

Investing is one of the best ways to grow your wealth, but it's important to do your research and invest in assets that you understand.

Tip 4: Reduce your debt.

Debt can be a major drag on your finances. Make a plan to pay off your debt as quickly as possible.

Tip 5: Increase your income.

If you want to build wealth, you need to find ways to increase your income. This could involve getting a raise, starting a side hustle, or investing in your education.

Tip 6: Seek professional advice.

If you're not sure how to get started building wealth, consider seeking professional advice from a financial advisor.

Summary: By following these tips, you can build wealth and achieve financial success. Remember, building wealth takes time and effort, but it's definitely possible.

Transition: Now that you have some tips for building wealth, let's discuss some of the challenges you may face.

Conclusion

Throughout this article, we have explored various aspects of Todd Helton's net worth, examining his income, spending, investments, assets, liabilities, and financial planning strategies. These elements collectively contribute to his overall financial well-being and provide insights into his approach towards wealth management.

Key takeaways from our analysis include the significance of strategic investments, prudent spending habits, and the impact of philanthropy on financial legacy. Helton's success story highlights the power of financial discipline and the positive impact that wealth can have on both an individual and the community.

How To Uncover Paul Gleason's Net Worth Secrets: A Comprehensive Guide For Biography Enthusiasts

How Ingrid Coronado Built Her Impressive Net Worth: Tips And Insights

How To Build Your ASMR Net Worth: Lessons From Heatheredeffect

ncG1vNJzZmirpaWys8DEmqRrZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmatp5SZeqmxy62mp2WemsFuw86rq6FmmKm6rQ%3D%3D